Brighthouse Shield Brochure

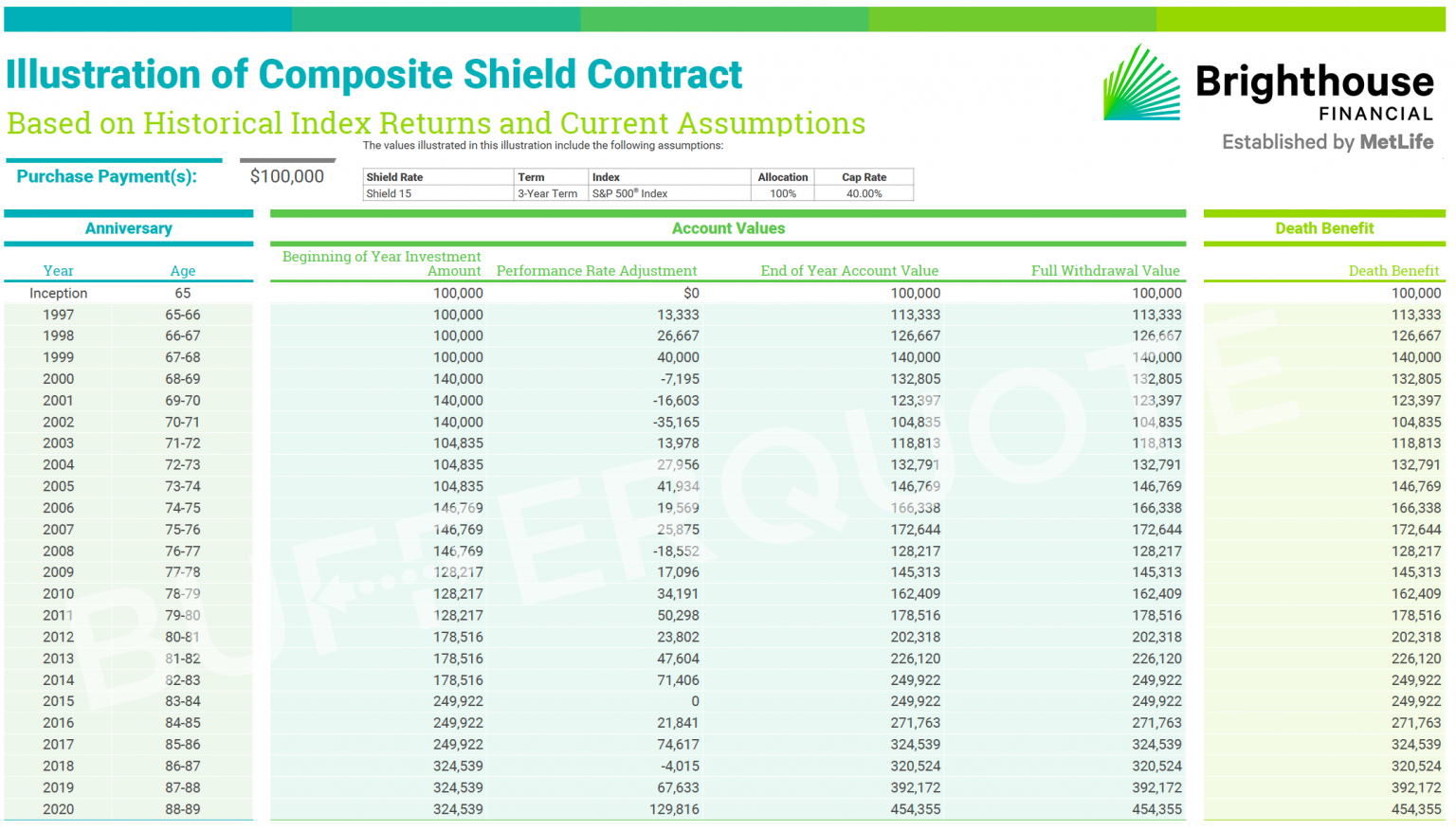

Brighthouse Shield Brochure - After talking with their financial professional, they've moved a portion of their existing investments into a shield annuity from brighthouse financial which means they can worry less about. Help protect a portion of your retirement assets and participate in opportunities that may provide stronger growth potential than you could get with some conservative investments1 by tracking. Like its name implies, a brighthouse shield level annuity is able to protect account assets from some of the losses that can derail portfolio performance. With security as its main selling point, it really does feel like a financial shield. Like its name implies, a brighthouse shield level ii annuity can help protect a portion of your portfolio from some of the losses that can derail plans. Discover how a level of protection and participation can lead to a brighter financial future. A brighthouse shield level select advisory annuity can add a level of protection for a portion of retirement assets while offering participation in potential growth opportunities with no annual. Are collectively referred to as “shield® level annuities” or “shield® annuities.” this brochure. It uses a portion of retirement assets to. See the product brochure for detailed rider information. The shield rate (level of protection) accrues daily and fully accrues. Help protect a portion of your retirement assets and participate in opportunities that may provide stronger growth potential than you could get with some conservative investments1 by tracking. It can help use a portion of retirement. A brighthouse shield level select advisory annuity can add a level of protection for a portion of retirement assets while offering participation in potential growth opportunities with no annual. Like its name implies, a brighthouse shield level ii annuity can help protect a portion of your portfolio from some of the losses that can derail plans. Like its name implies, a brighthouse shield level annuity is able to protect account assets from some of the losses that can derail portfolio performance. Discover how a level of protection and participation can lead to a brighter financial future. Participate in rising markets up to your rate crediting type. Growth opportunities are based on the elected rate crediting type. It uses a portion of retirement assets to. A brighthouse shield level select advisory annuity can add a level of protection for a portion of retirement assets while offering participation in potential growth opportunities with no annual. Determine whether your retirement savings will generate enough income to cover your expenses in retirement and discover how a. Are collectively referred to as “shield® level annuities” or “shield® annuities.” this. After talking with their financial professional, they've moved a portion of their existing investments into a shield annuity from brighthouse financial which means they can worry less about. Determine whether your retirement savings will generate enough income to cover your expenses in retirement and discover how a. It uses a portion of retirement assets to. With security as its main. Growth opportunities are based on the elected rate crediting type. A brighthouse shield level select advisory annuity can add a level of protection for a portion of retirement assets while offering participation in potential growth opportunities with no annual. Discover how a level of protection and participation can lead to a brighter financial future. Participate in rising markets up to. It uses a portion of retirement assets to. Help protect a portion of your retirement assets and participate in opportunities that may provide stronger growth potential than you could get with some conservative investments1 by tracking. Level annuity” or “shield ®. 4.5/5 (193 reviews) It can help use a portion of retirement. Help protect a portion of your retirement assets and participate in opportunities that may provide stronger growth potential than you could get with some conservative investments1 by tracking. It can help use a portion of retirement. Shield level selector can help you prepare for the long term with customized levels of protection for a portion of your retirement assets using. After talking with their financial professional, they've moved a portion of their existing investments into a shield annuity from brighthouse financial which means they can worry less about. The shield rate (level of protection) accrues daily and fully accrues. Annuity are collectively referred to. Participate in rising markets up to your rate crediting type. It can help use a portion. Annuity are collectively referred to. With security as its main selling point, it really does feel like a financial shield. The shield rate (level of protection) accrues daily and fully accrues. Are collectively referred to as “shield® level annuities” or “shield® annuities.” this brochure. 4.5/5 (193 reviews) The shield rate (level of protection) accrues daily and fully accrues. Growth opportunities are based on the elected rate crediting type. 4.5/5 (193 reviews) Determine whether your retirement savings will generate enough income to cover your expenses in retirement and discover how a. After talking with their financial professional, they've moved a portion of their existing investments into a shield. Help protect a portion of your retirement assets and participate in opportunities that may provide stronger growth potential than you could get with some conservative investments1 by tracking. Determine whether your retirement savings will generate enough income to cover your expenses in retirement and discover how a. Are collectively referred to as “shield® level annuities” or “shield® annuities.” this brochure.. A shield annuity helps protect a portion of retirement assets while offering diversified growth opportunities. After talking with their financial professional, they've moved a portion of their existing investments into a shield annuity from brighthouse financial which means they can worry less about. Growth opportunities are based on the elected rate crediting type. Shield level selector can help you prepare. Level annuity” or “shield ®. With security as its main selling point, it really does feel like a financial shield. It uses a portion of retirement assets to. 4.5/5 (193 reviews) It can help use a portion of retirement. Growth opportunities are based on the elected rate crediting type. Like its name implies, a brighthouse shield level annuity is able to protect account assets from some of the losses that can derail portfolio performance. See the product brochure for detailed rider information. Like its name implies, a brighthouse shield level ii annuity can help protect a portion of your portfolio from some of the losses that can derail plans. Determine whether your retirement savings will generate enough income to cover your expenses in retirement and discover how a. Help protect a portion of your retirement assets and participate in opportunities that may provide stronger growth potential than you could get with some conservative investments1 by tracking. Discover how a level of protection and participation can lead to a brighter financial future. A brighthouse shield level select advisory annuity can add a level of protection for a portion of retirement assets while offering participation in potential growth opportunities with no annual. Annuity are collectively referred to. After talking with their financial professional, they've moved a portion of their existing investments into a shield annuity from brighthouse financial which means they can worry less about. Shield level selector can help you prepare for the long term with customized levels of protection for a portion of your retirement assets using the available shield options.Brighthouse Shield Annuity Review Annuity Look

Brighthouse Financial Shield Kit — Nick

Brighthouse Shield Annuity Review Annuity Look

A Brighthouse Shield ® Level Annuity can help.

Brighthouse Shield® Level Annuities Growth & Protection

Brighthouse Shield on Vimeo

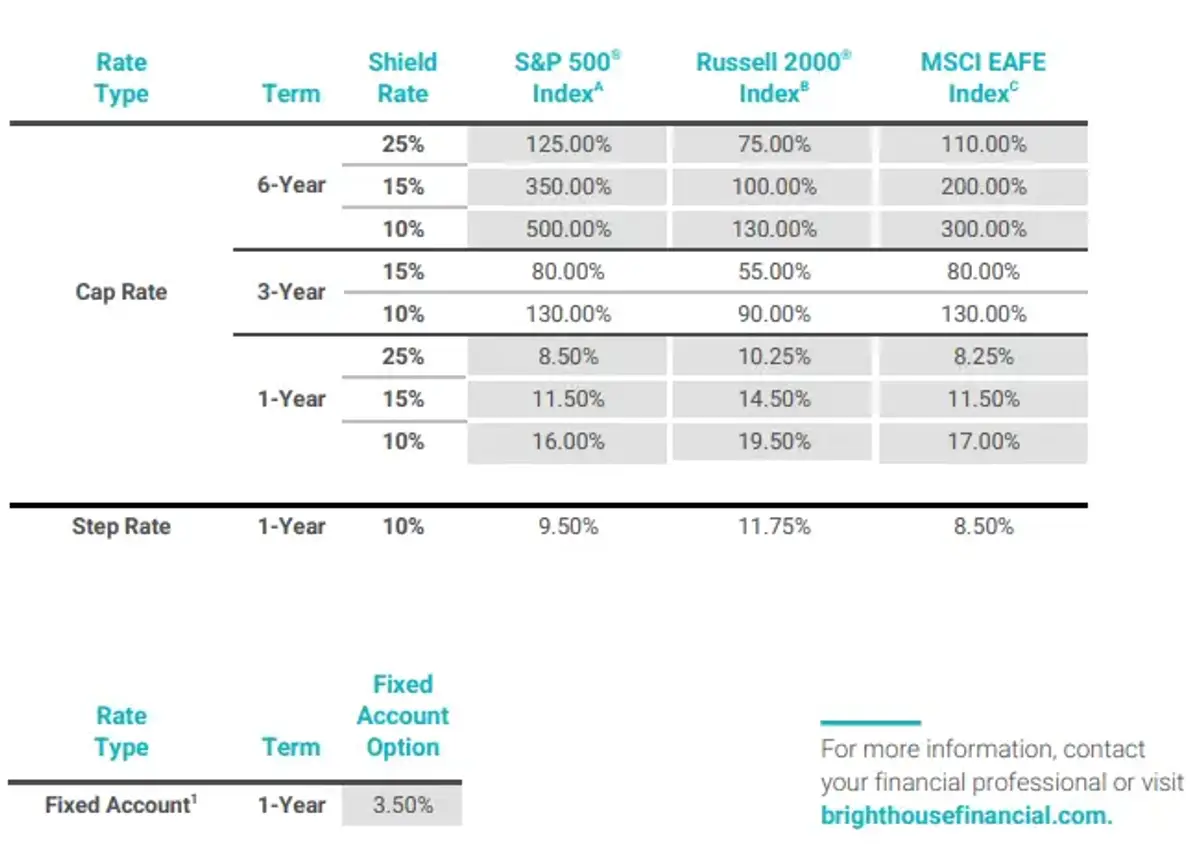

Brighthouse Financial Expands Flagship Shield Level Annuity Suite With

Brighthouse Financial Introduces Enhancements to Its Flagship Shield

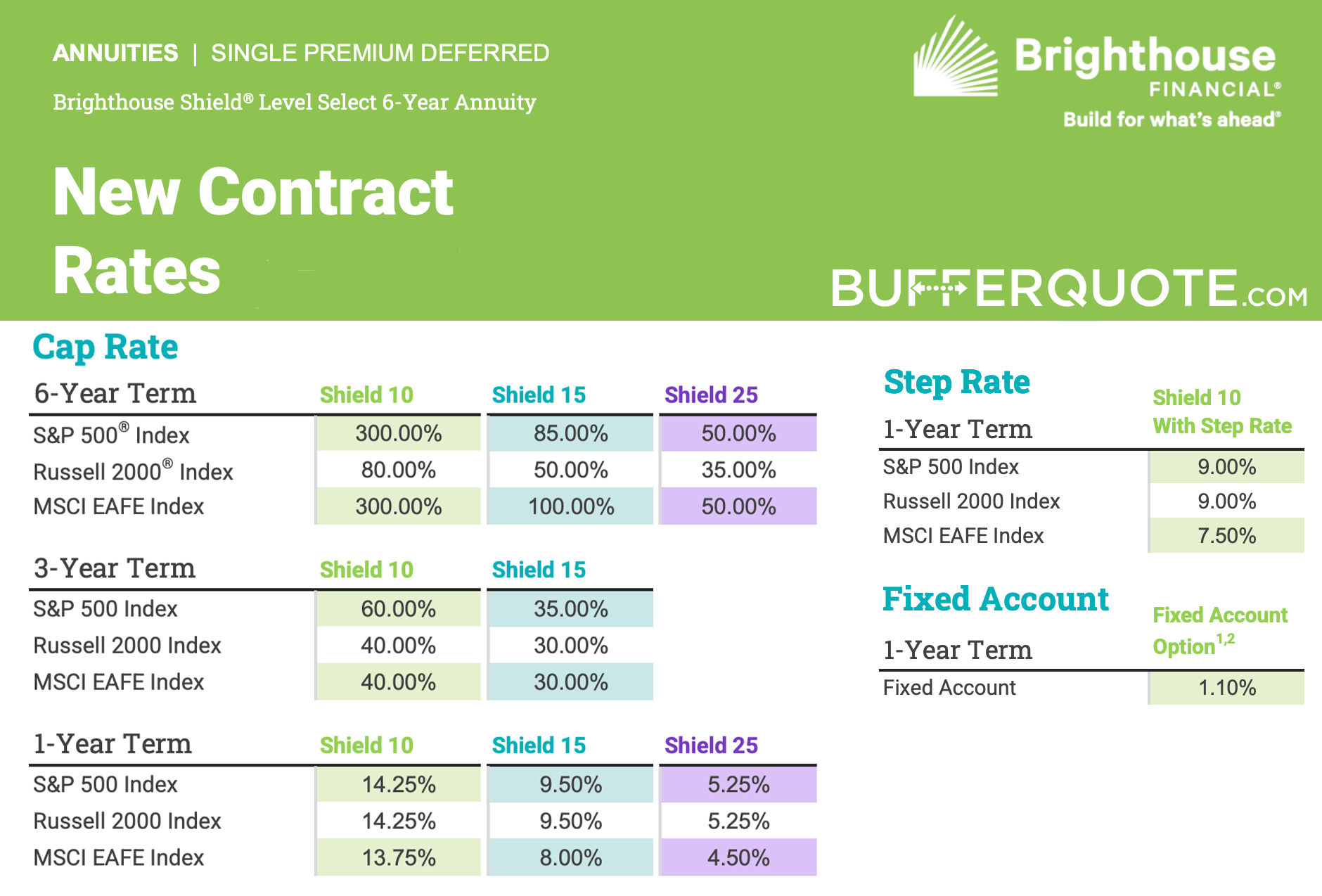

PPT Annuity and Life Insurance Product Update PowerPoint Presentation

A Brighthouse Shield ® Level Annuity can help.

A Shield Annuity Helps Protect A Portion Of Retirement Assets While Offering Diversified Growth Opportunities.

The Shield Rate (Level Of Protection) Accrues Daily And Fully Accrues.

Are Collectively Referred To As “Shield® Level Annuities” Or “Shield® Annuities.” This Brochure.

Participate In Rising Markets Up To Your Rate Crediting Type.

Related Post: