Fema Increased Cost Of Compliance Brochure

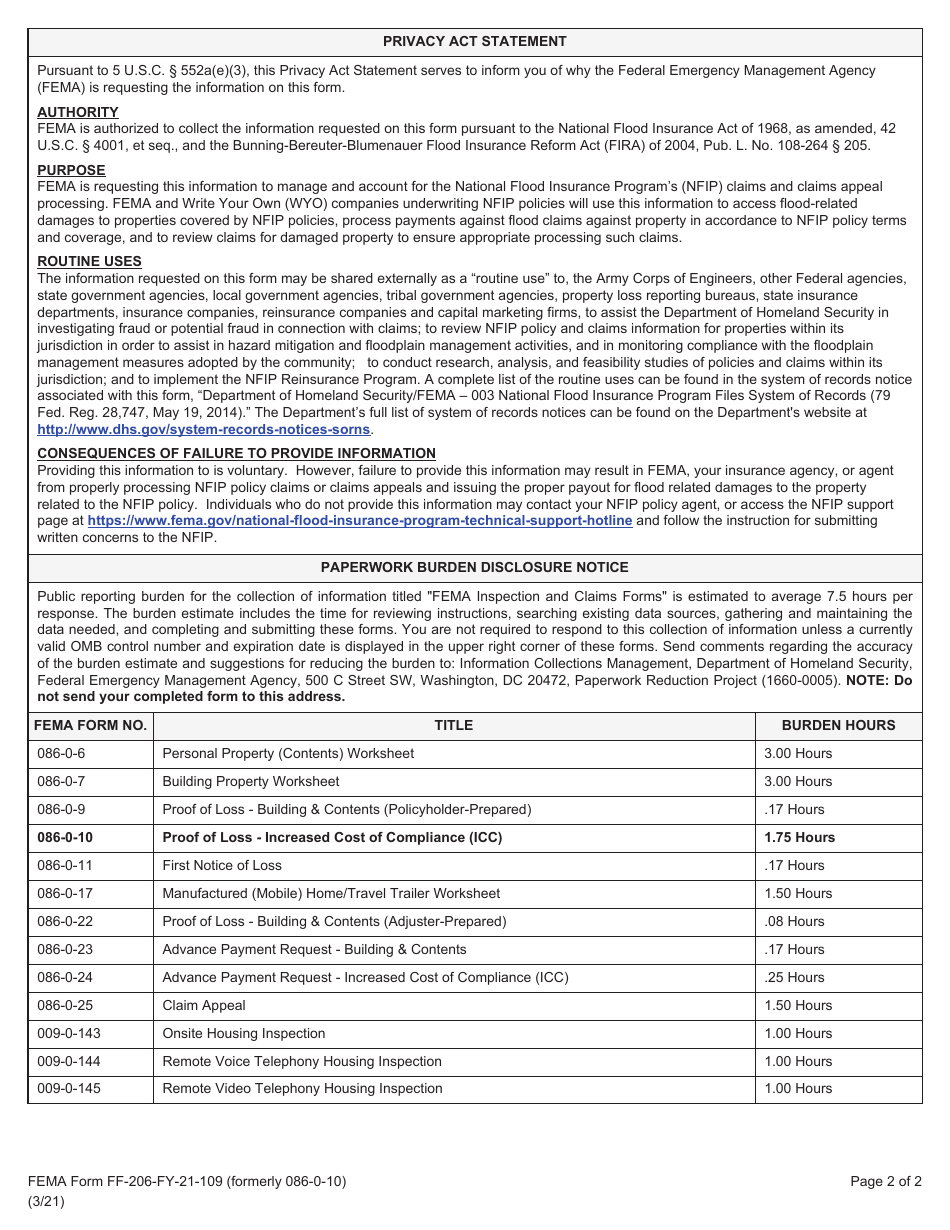

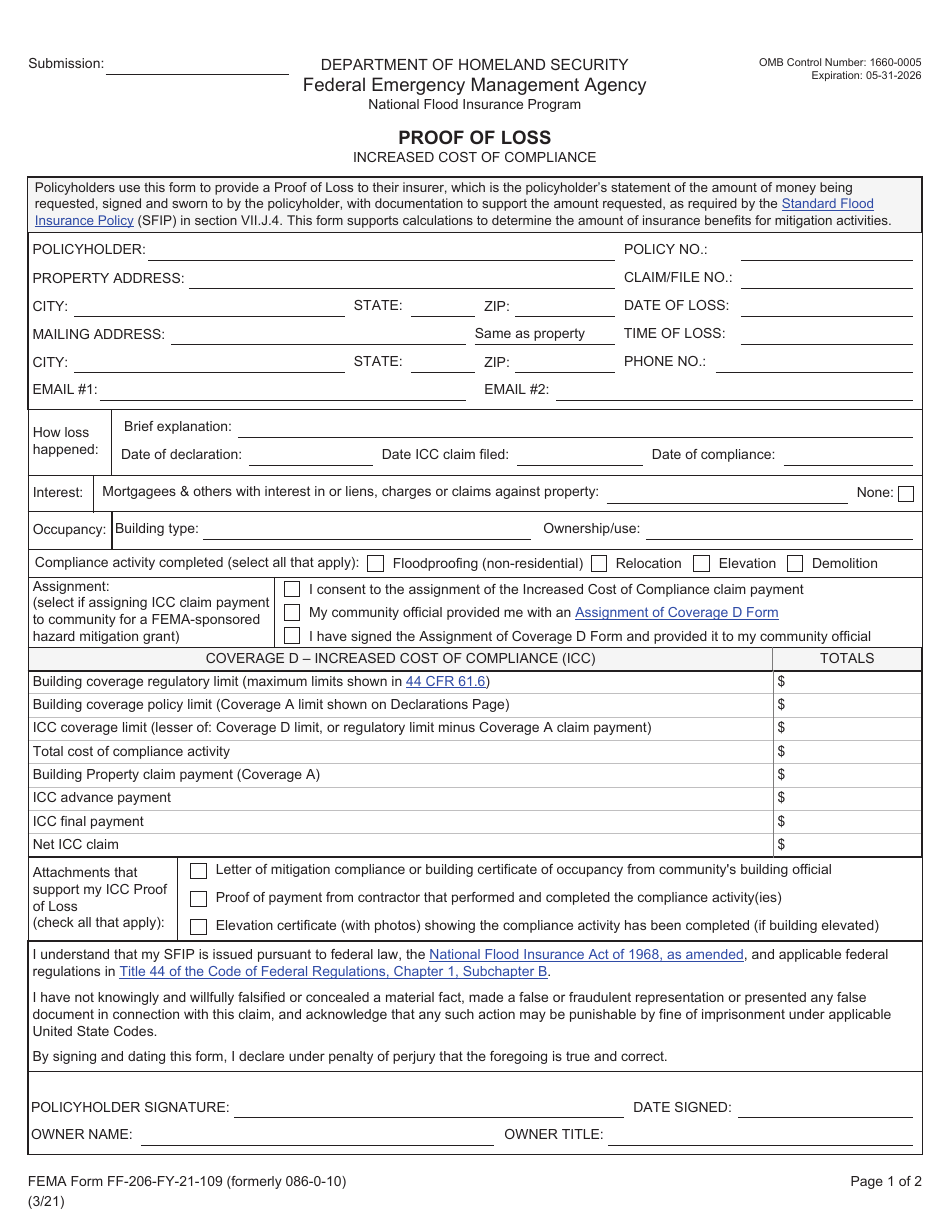

Fema Increased Cost Of Compliance Brochure - At the time of loss, the policyholders had $53,000 of building coverage and $23,400 of personal property coverage. It provides up to $30,000 to. Is your building insured through the national flood insurance program (nfip) with a standard flood insurance policy (sfip)? National flood insurance program (nfip) policyholders are eligible for an increased cost of compliance (icc) claim benefit provided that certain eligibility criteria are satisfied. If so, you may be eligible for up to $30,000 in increased cost. To help you cover the costs of meeting those requirements, the national flood insurance program (nfip) includes increased cost of compliance (icc) coverage for all new and. O ers increased cost of compliance (icc) coverage. Increased cost of compliance (icc) coverage is one of several resources for flood insurance policyholders who need additional help rebuilding after a flood. If so, you may be eligible for up to $30,000 in increased cost of compliance (icc) coverage. Increased cost of compliance (icc) coverage is one of several resources for flood insurance policyholders who need additional help rebuilding after a flood. O ers increased cost of compliance (icc) coverage. Increased cost of compliance, or icc, coverage is part of most standard flood insurance policies. It provides up to $30,000 to. Increased cost of compliance (icc) coverage is one of several resources for flood insurance policyholders who need additional help rebuilding after a flood. Increased cost of compliance coverage provides for the payment of a claim for the cost to comply with state or community floodplain management laws or ordinances after a direct physical loss. To help you cover the costs of meeting those requirements, the national flood insurance program (nfip) includes increased cost of compliance (icc) coverage for all new and. Increased cost of compliance (icc) coverage provides a claim payment for the cost to comply with state or community floodplain management laws or ordinances after a. Increased cost of compliance (icc) coverage provides a claim payment, after a direct loss by flood, for the cost to comply with state or community floodplain management. Is your building insured through the national flood insurance program (nfip) with a standard flood insurance policy (sfip)? To help you cover the costs of meeting those requirements, the national flood insurance program (nfip) includes increased cost of compliance (icc) coverage for all new and. Increased cost of compliance (icc) coverage provides a claim payment for the cost to comply with state or community floodplain management laws or ordinances after a. O ers increased cost of compliance (icc) coverage. To help you cover the costs of bringing your home or business into compliance, the national flood insurance program (nfip) offers eligible policyholders up to $30,000. For policyholders like rachel who need additional funds to rebuild after a flood, you may qualify for up to $30,000 for mitigation measures that will reduce your flood risk in the future. In its review, fema found the following facts relevant: To help you cover the costs of bringing your home or business into compliance, the national flood insurance program. To help you cover the costs of meeting those requirements, the national flood insurance program (nfip) includes increased cost of compliance (icc) coverage for all new and. Increased cost of compliance, or icc, coverage is part of most standard flood insurance policies. Increased cost of compliance (icc) coverage is one of several resources for flood insurance policyholders who need additional. National flood insurance program (nfip) policyholders are eligible for an increased cost of compliance (icc) claim benefit provided that certain eligibility criteria are satisfied. It provides up to $30,000 to. It provides up to $30,000 to. Increased cost of compliance funds. Is your building insured through the national flood insurance program (nfip) with a standard flood insurance policy (sfip)? At the time of loss, the policyholders had $53,000 of building coverage and $23,400 of personal property coverage. Increased cost of compliance funds. To help you cover the costs of meeting those requirements, the national flood insurance program (nfip) includes increased cost of compliance (icc) coverage for all new and. O ers increased cost of compliance (icc) coverage. Increased cost. Increased cost of compliance coverage how you can benefit if your building is damaged by a flood, you may be required to meet certain building requirements in your community to reduce. Increased cost of compliance (icc) coverage is one of several resources for flood insurance policyholders who need additional help rebuilding after a flood. If so, you may be eligible. Increased cost of compliance (icc) coverage is one of several resources for flood insurance policyholders who need additional help rebuilding after a flood. It provides up to $30,000 to. It provides up to $30,000 to. O ers increased cost of compliance (icc) coverage. Is your building insured through the national flood insurance program (nfip) with a standard flood insurance policy. Claims for icc benefits are filed separately from your claim for contents or building. It provides up to $30,000 to. Increased cost of compliance, or icc, coverage is part of most standard flood insurance policies. Increased cost of compliance coverage how you can benefit if your building is damaged by a flood, you may be required to meet certain building. It provides up to $30,000 to. National flood insurance program (nfip) policyholders are eligible for an increased cost of compliance (icc) claim benefit provided that certain eligibility criteria are satisfied. O ers increased cost of compliance (icc) coverage. Is your building insured through the national flood insurance program (nfip) with a standard flood insurance policy (sfip)? Increased cost of compliance. Increased cost of compliance coverage how you can benefit if your building is damaged by a flood, you may be required to meet certain building requirements in your community to reduce. Claims for icc benefits are filed separately from your claim for contents or building. Increased cost of compliance funds. Increased cost of compliance (icc) coverage is one of several. It provides up to $30,000 to. It provides up to $30,000 to. Increased cost of compliance (icc) coverage is one of several resources for flood insurance policyholders who need additional help rebuilding after a flood. Is your building insured through the national flood insurance program (nfip) with a standard flood insurance policy (sfip)? If so, you may be eligible for up to $30,000 in increased cost of compliance (icc) coverage. To help you cover the costs of meeting those requirements, the national flood insurance program (nfip) includes increased cost of compliance (icc) coverage for all new and. To help you cover the costs of bringing your home or business into compliance, the national flood insurance program (nfip) offers eligible policyholders up to $30,000 of increased cost. Increased cost of compliance (icc) coverage is one of several resources for flood insurance policyholders who need additional help rebuilding after a flood. Claims for icc benefits are filed separately from your claim for contents or building. In its review, fema found the following facts relevant: National flood insurance program (nfip) policyholders are eligible for an increased cost of compliance (icc) claim benefit provided that certain eligibility criteria are satisfied. O ers increased cost of compliance (icc) coverage. Increased cost of compliance (icc) coverage is one of several resources for flood insurance policyholders who need additional help rebuilding after a flood. Icc will help cover the costs of meeting the community’s rebuilding requirements that will protect. To help you cover the costs of meeting those requirements, the national flood insurance program (nfip) includes increased cost of compliance (icc) coverage for all new and. It provides up to $30,000 to.FEMA Form FF206FY21109 Fill Out, Sign Online and Download

LEARN ABOUT FEMA’S BCA AND HOW OUR EXPERTS CAN HELP YOUR PROJECTS STAY

Cobertura del aumento en el costo de cumplimiento (Increased Cost of

Fillable Online fema INCREASED COST OF COMPLIANCE (ICC) fema Fax

FEMA Compliance Simplified with Expertise

FEMA Form FF206FY21109 Fill Out, Sign Online and Download

Fema 2024 Cost Codes List Clare Desirae

Vyom Tax Compliance

Individuals Floodplain Management Resources FEMA.gov

Detail Information On FEMA Compliance

Increased Cost Of Compliance Coverage Provides For The Payment Of A Claim For The Cost To Comply With State Or Community Floodplain Management Laws Or Ordinances After A Direct Physical Loss.

At The Time Of Loss, The Policyholders Had $53,000 Of Building Coverage And $23,400 Of Personal Property Coverage.

For Policyholders Like Rachel Who Need Additional Funds To Rebuild After A Flood, You May Qualify For Up To $30,000 For Mitigation Measures That Will Reduce Your Flood Risk In The Future.

It Provides Up To $30,000 To.

Related Post: