Mutual Of Omaha Final Expense Brochure

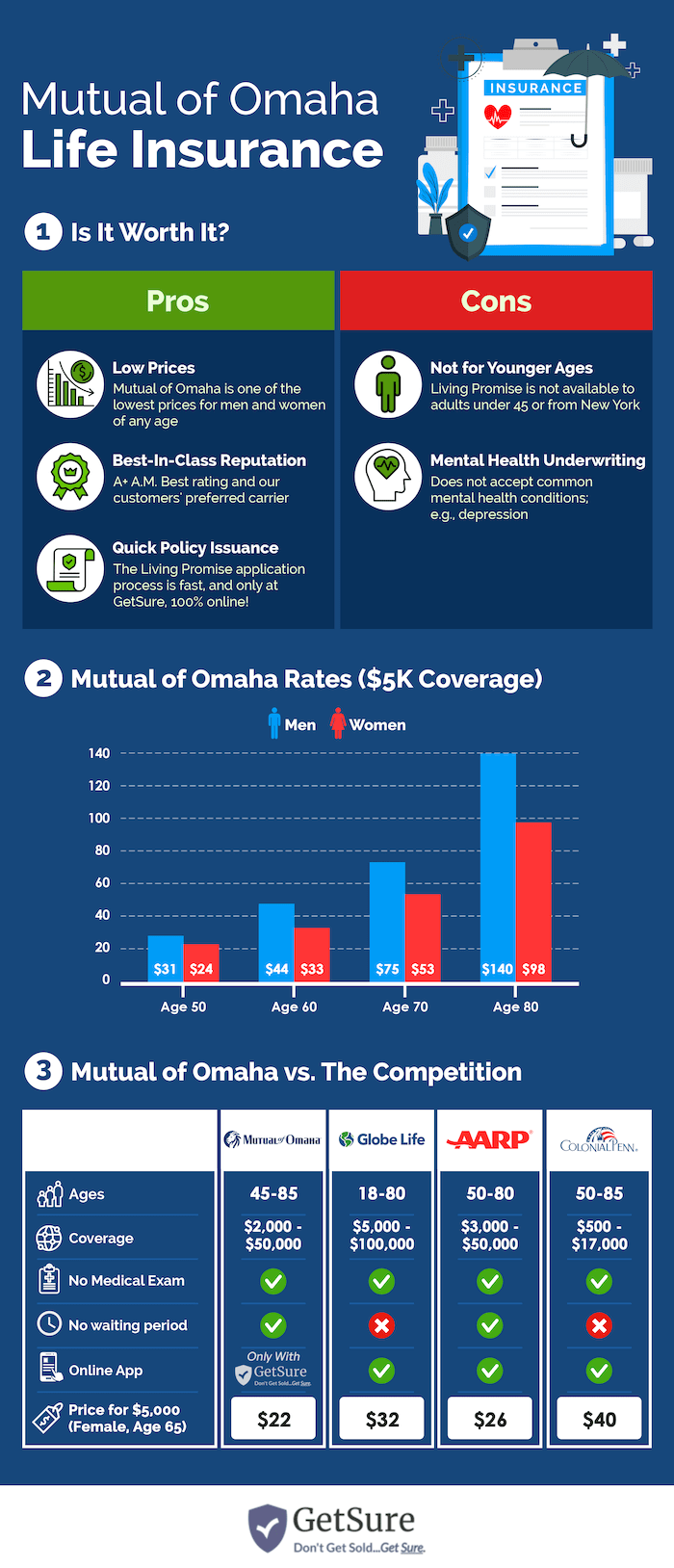

Mutual Of Omaha Final Expense Brochure - Mutual of omaha’s whole life insurance selection is designed to meet the needs of the policyholder with substantial guarantees and. Product base plans, provisions, features, and riders may not. Ready to calculate your final expense needs? Outstanding medical bills, unexpected expenses or debt that you may leave behind. In this webinar, we focus on final expense insurance and gain valuable insights into key coverage types and products. Guaranteed approvalsspeak to live agentshop & comparehelp covering burial cost A living promise whole life insurance policy from united of omaha life insurance company (united of omaha) pays benefits directly to the person you. It’s a thoughtful, caring way to take care of the ones Mutual of omaha affiliates 128042 happy ay pa living promise whole life insurance product and underwriting guide. Living promise whole life insurance is one way for you to help protect loved ones during a difficult time. Whole / term prescription guide. In this webinar, we focus on final expense insurance and gain valuable insights into key coverage types and products. Experts will discuss differences between underwriting types, benefit. Outstanding medical bills, unexpected expenses or debt that you may leave behind. Helping with your final expenses and more this is a solicitation of insurance. United of omaha life insurance company pays benefits directly to the person you choose. Living promise whole life insurance is one way for you to help protect loved ones during a difficult time. Issue coverage with united of omaha the death benefit will not be paid if the insured commits suicide, while sane or insane, within two years from the contestability date (in nd, within one. Ready to calculate your final expense needs? Mutual of omaha affiliates 128042 happy ay pa living promise whole life insurance product and underwriting guide. It can help take care of your final expenses, including outstanding medical bills or debt that you may. Whole / term prescription guide. Having a whole life insurance policy in place can be a very loving and considerate thing to do for your. Age male female age male female age male female age male female 45 $37.89 $28.56 54 $49.90. Guaranteed approvalsspeak to live agentshop & comparehelp covering burial cost Experts will discuss differences between underwriting types, benefit. Helping with your final expenses and more this is a solicitation of insurance. Living promise whole life insurance is one way for you to help protect loved ones during a difficult time. In this webinar, we focus on final expense insurance and. A living promise whole life insurance policy from united of omaha life insurance company (united of omaha) pays benefits directly to the person you. Issue coverage with united of omaha the death benefit will not be paid if the insured commits suicide, while sane or insane, within two years from the contestability date (in nd, within one. It can help. It’s a thoughtful, caring way to take care of the ones Issue coverage with united of omaha the death benefit will not be paid if the insured commits suicide, while sane or insane, within two years from the contestability date (in nd, within one. Whole / term prescription guide. Mutual of omaha’s whole life insurance selection is designed to meet. Try our digital final expenses calculator. Living promise whole life insurance. Request a free quote online or call a. Whole life and final expense insurance. You can help protect your loved ones from the costs of your final expenses with a living promise whole life insurance policy. Guaranteed approvalsspeak to live agentshop & comparehelp covering burial cost Learn how a guaranteed whole life insurance policy from mutual of omaha can help your family pay for your funeral and other costs after you pass away. Living promise whole life insurance. Experts will discuss differences between underwriting types, benefit. It’s a thoughtful, caring way to take care of the. Ready to calculate your final expense needs? Experts will discuss differences between underwriting types, benefit. Issue coverage with united of omaha the death benefit will not be paid if the insured commits suicide, while sane or insane, within two years from the contestability date (in nd, within one. You can help protect your loved ones from the costs of your. Living promise whole life insurance is one way for you to help protect loved ones during a difficult time. A licensed agent may contact you. Mutual of omaha affiliates 128042 happy ay pa living promise whole life insurance product and underwriting guide. Product base plans, provisions, features, and riders may not. Living promise whole life insurance. Helping with your final expenses and more this is a solicitation of insurance. Experts will discuss differences between underwriting types, benefit. Ready to calculate your final expense needs? Guaranteed approvalsspeak to live agentshop & comparehelp covering burial cost Learn how a guaranteed whole life insurance policy from mutual of omaha can help your family pay for your funeral and other. Whole life and final expense insurance. Issue coverage with united of omaha the death benefit will not be paid if the insured commits suicide, while sane or insane, within two years from the contestability date (in nd, within one. Request a free quote online or call a. Try our digital final expenses calculator. Living promise whole life insurance is one. Living promise whole life insurance. Mutual of omaha affiliates 128042 happy ay pa living promise whole life insurance product and underwriting guide. You can help protect your loved ones from the costs of your final expenses with a living promise whole life insurance policy. United of omaha life insurance company pays benefits directly to the person you choose. Whole / term prescription guide. In this webinar, we focus on final expense insurance and gain valuable insights into key coverage types and products. It’s a thoughtful, caring way to take care of the ones Living promise whole life insurance is one way for you to help protect loved ones during a difficult time. Request a free quote online or call a. Product base plans, provisions, features, and riders may not. A living promise whole life insurance policy from united of omaha life insurance company (united of omaha) pays benefits directly to the person you. Ready to calculate your final expense needs? Experts will discuss differences between underwriting types, benefit. Helping with your final expenses and more this is a solicitation of insurance. Issue coverage with united of omaha the death benefit will not be paid if the insured commits suicide, while sane or insane, within two years from the contestability date (in nd, within one. Having a whole life insurance policy in place can be a very loving and considerate thing to do for your.Mutual of Omaha Your Insurance Group Agents

Mutual Of Omaha Living Promise Burial Insurance [7 Things To Know

Mutual Of Omaha Whole Life Insurance Final Expense Insurance

Mutual of Omaha Life Insurance For Seniors

Mutual Of Omaha Final Expense Product Review [For Agents Only] Duford

Mutual of Omaha Guaranteed Whole Life Insurance Policy TV Commercial

Mutual of Omaha Final Expense Insurance Review [Worth Having a Look]

Mutual Of Omaha Living Promise Burial Insurance [7 Things To Know

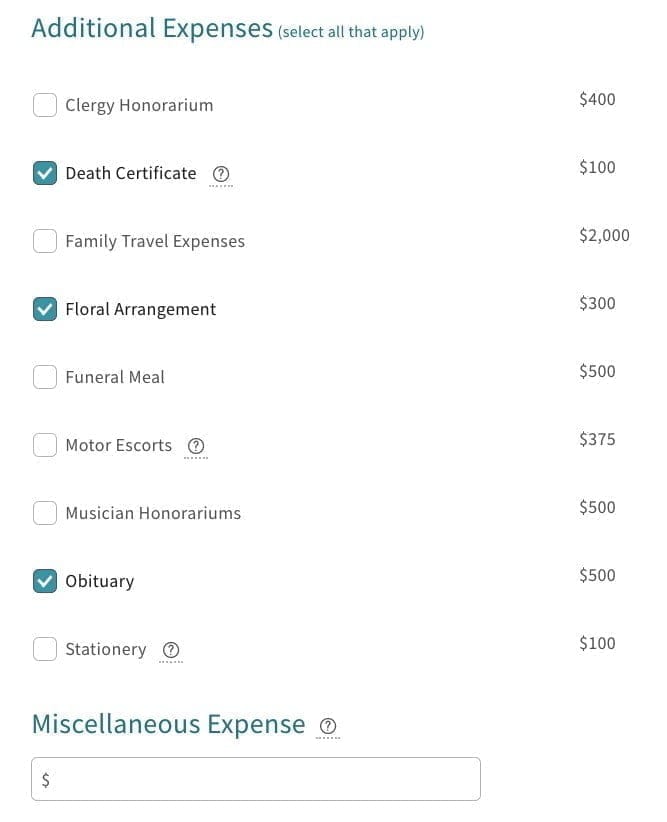

final expense

American Independent MarketingGerber Final Expense Brochure American

Funds May Be Used For Final Expenses And Other Purposes.

Age Male Female Age Male Female Age Male Female Age Male Female 45 $37.89 $28.56 54 $49.90 $37.10 63 $66.86 $54.62 72 $101.23 $87.53 46 $38.90 $28.90 55 $51.48 $39.23 64.

Guaranteed Approvalsspeak To Live Agentshop & Comparehelp Covering Burial Cost

Outstanding Medical Bills, Unexpected Expenses Or Debt That You May Leave Behind.

Related Post:

![Mutual Of Omaha Final Expense Product Review [For Agents Only] Duford](https://davidduford.com/wp-content/uploads/2019/11/mutual-of-omaha-final-expense-review.jpg)

![Mutual of Omaha Final Expense Insurance Review [Worth Having a Look]](https://seniorslifeinsurancefinder.com/wp-content/uploads/2021/08/Mutual-of-Omaha-Final-Expense-Insurance-Review.png)